List of Singapore finance telegram channels

Updated: 21/5/2020

To be updated from time to time!Do comment below if you have any idea:)

Discussion channels(stocks and forex)

@investorsexchange (stocks discussion telegram group)

@DividendInvestment(stocks discussion telegram group)

@FundamentalInvestors(stocks discussion telegram group)

@FinanceCafe(stocks discussion telegram group)

@sgfinancialndependence (stock discussion telegram group)

@sgstockchat(stocks and forex discussion telegram group)

Discussion channel(crypto)

@CryptoSG: https://t.me/CryptoSG

Personal finance and blogs

@budgetbabes (budget babe telegram channel)

@Dollarandsense(Dollar and sense telegram channel)

@PersonalFinanceSg (Seedly)

@SingaporeFinanceBot(Finance bot)

@Sonicericsg (personal finance blog)

@wokesalaryman (Comics strip of personal finance)

@fipharmarcistsg(personal finance channel of an pharmacist undergraduate)

Showing posts with label Tip For Thought. Show all posts

Showing posts with label Tip For Thought. Show all posts

Thursday 21 May 2020

Saturday 21 March 2020

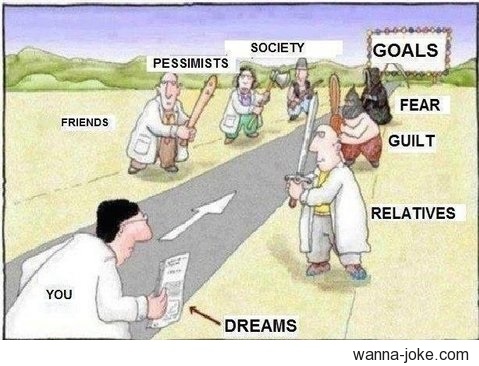

[Post 104] TipforThought:What's the hardest truth of life? and What's are the biggest career mistakes to avoid

- Your parents are the only people who become genuinely happy when you succeed.

- People want to see you succeed… but not more than them.

- A friend in need is a friend indeed. The reverse is true if you get what I mean.

- The way you are brought up contributes about 70% to the person you grow up to be. unfortunately, we don't get to choose our parents.

- Genuine love is rare if you stumble upon it cherish it.

- Nobody will die for you. You are on your own so man up.

- Life is so unfair but it is still beautiful.

- Bad things happen to good people.

- Growing up comes with more responsibilities, thus life gets even harder as you grow.

- Life is a journey with an unknown destination. You only cross the bridge when you get there… sometimes you are not even sure whether the bridge is there or not. Live today tomorrow is not promised.

#1. Aiming too low. Whether it’s salary, title, or type of company, people are too intimidated by interviewers, scared of asking for what they want at every stage of the interview process, and suffer from imposter syndrome.

This is a direct result of decades of indoctrination by authoritative educational, parental, and societal institutions that tend to demolish your self-confidence in an effort to control you. This persistent lack of confidence is the #1 issue candidates suffer from when it comes to selling yourself effectively.

#2. Saying no to yourself. Because you feel that you lack the “qualifications” the job description asks for, you end up not going for the opportunity. This continued lack of self-confidence through self-discrimination, combined with the obsession of fulfilling requirements down to the last drop, handicaps good professionals from achieving career greatness.

Although job description doesn't matter, many candidates still try to play by the rules. They don’t understand that the job search is like war. The victor obtains the spoils. It’s every man and woman for themselves.

There are NO rules in job search! This is why often psychopaths and liars sometimes get the BEST jobs and offers. They understand manipulation.

Too often, the most accomplished candidates lose because they don’t know the song and dance that is the job search.

#3. Not understanding the modern job search ecosystem and process. There are 4 major hiring entities that you need to know how to manipulate, maneuver around, and negotiate with. The HR person, hiring manager, headhunter, and internal recruiter. Each person has a slightly different incentive, process, and interaction protocol. You should behave accordingly.

In addition, the process of job search is no longer: look on the web for listings, apply to jobs that you like, wait for feedback, go interview. The new process is: create your marketing documents (including your resume ), master LinkedIn networking, leverage the 4 hiring entities mentioned above, utilize the volume of interviews to your advantage, negotiate all throughout.

#4. Becoming a jack of all trades. The most dangerous problem candidates run into that seriously limits their market value and range of future career options is becoming a generalist. Corporations no longer value soldiers, willing to do any deed for pay. They want professionals, experts, and true masters of the industry and job vertical. They NEED these experts to remain viable and stay ahead of their competition.

No longer is being eager and willing to work for a firm for the next 25 years a valuable candidate trait. Firms want true market leaders. That means, specialization and experience within a niche skill are not only a good-to-have, but a MUST-HAVE to remain a relevant and desirable professional.

Lastly, #5. Having no financial plan nor power. Most professionals forget that they work largely to make a living. Since most people accumulate worse spending habits every year, people rely on their jobs more and more to fuel their lifestyle. This dependent relationship on a job quickly spirals out of control once their house of cards experiences even the smallest tremor.

Because of your deep reliance on your paycheck, your emotions run amok when experiencing any type of career turbulence.

Since your financial woes are so heavy and over-leveraged, you can’t see straight, let alone find a career you enjoy!

In most of these cases, professionals tend to work simply to chase the dollar, losing all meaning and passion for what they’re working towards outside of living the high life they buy with their post-tax dollars. They become money-mongers. Greed takes precedence. Career meaning, purpose, and ethical behavior quickly fall by the wayside when confronted by financial greed.

This is the #1 cause of corporate fraud, corruption, pollution, and general nastiness (think: Wolf of Wall Street, Enron, and Bernie Madoff). Individual greed driven by a need to keep up with the Joneses pollutes corporate cultures by attracting people who are in it just for the money.

In conclusion

Career problems aren’t simply an amalgamation of your job’s stressors. Your personal, financial, and professional problems, weaknesses, and vices will all meld together to gang up on you, if you let your guard down or stray off the righteous path of moral behavior.

Stay ahead of the game by learning, networking, and speaking with career experts, colleagues, mentors, and influencers that have the RIGHT advice to guide you.

Thanks for reading!

Thanks for reading!

Sunday 23 February 2020

[Post 103] TipforThought: Building and managing your portfolio

Quick guide on building and managing your portfolio!

1.Getting started and what to watch out for

- Most people save and invest because they want some money for future goal.

- If you are new to investing ,here are some step to help you get started on an investment plan.

2.Setting goals

- What are your goals?Common goals include paying off your student loan ,accumulating fund for retirement or savings for your children education

- Work out how much money you need for your goal

- Work out when you need the money for your goal.The time you have available to invest leading up to when the money is needed is known as your investment horizon.

3.How much can you afford to invest?

- How much money do you have available to invest ,after paying your household expenses,insurance premium and debt as well as setting aside some savings?

- Can you cut back some expenses to free up more money for saving or investing?If your investment suffer a loss,will it impact your debt and other commitment ,or others goals?

- Do not commit to pay or invest more than you can possibly afford long term.Look for a cost-effective alternative .If the product requires you to pay,what will be consequences if you do not have enough to pay.

- Do you intend to invest in one lump sum or fixed amount a regular amount ?e.g monthly,annually?

- How much time do you have/what's your age ?/do you have time to ride out short term fluctuations or losses

4.Know yourself and how some investing basics apply to you

5.Consolidate and priorities your goals

- After examining what you need ,when you need it,how much you can invest , and how much risk you can afford to take.

- You may need to re-prioritize your goals.You may need to settle for a smaller house or a smaller car,but it would be unwise not to build up adequate retirement savings and provide for adequate healthcare cover.

6.What's step should you take to achieve your goals?

- This could be saving up or Investing in a diversified portfolio to help you achieve what you need.Always keep the step above in mind when considering what action to take .

- Choose your investment based on how suitable it is for your needs and personal circumstances,how well you understand the product ,and how it will fit in your diversified portfolio to reach your investment objectives

- Do find out whether you can manage risk or limit losses once you are invested.Remember there are product where you can lose all your initial investment,products where you can lose more than your initial investment and products whose market values go up and down.

- With the latter,do be aware that markets could be at a downtown when you want to take out your money,so it is important to monitor your investments carefully in case you need to liquidate or take other action sooner.

- Do consider dollar cost averaging as a means to accumulating the assets you want

7.Monitoring Performance,Rebalancing and Adjusting your investments

- Investing is an on-going responsibility.Even if you can choose to be somewhat passive -Investing in unit trusts or funds that track indices - you should regularly review the performance of your investments to see if you are on track to achieving your goals .

- Keep watch over the factors which may influence the performance of your investments .You may need to take if your investment is under performing.

Thanks for reading!

Tuesday 11 June 2019

[Post 92] How to properly valuate a company?

Credit to growth investor from investing note(investing note has lots of good tidbits)

These are the valuation metrics that are commonly used:

- Price to Earnings Ratio (P/E)

- Price to Book Ratio (P/B)

- Discounted Cash Flows (DCF)

- and others…

P/E: This is the simplest of all. It is simply = Share Price divided by Earnings Per Share (EPS).

Trailing P/E refers to Current Share Price divided by the EPS over the past 12 months.

Forward P/E refers to Current Share Price divided by the forecasted EPS for the next 12 months.

A layman’s interpretation of P/E is how much I am willing to pay for the company’s earnings. Example: A P/E of 15 means I am willing to pay 15 times per share for its earnings.

To me, P/E by itself is quite meaningless. It is useful only if you compare the company to its peers’ P/E or the industry average P/E, to judge whether it is under or overvalued.

P/B: Book value is the amount of cash I would get if I were to liquidate the company *today*. It’s like the “net worth” of a company. It is the sum of assets minus total liabilities. Sometimes “Net Asset Value” is used loosely interchangeably as “book value”. Book value per share is simply the book value divided by the total number of shares. P/B is thus Share Price divided by Book Value per share.

A P/B smaller than 1 means the share price is undervalued in terms of book value, while a P/B greater than 1 means overvalued. A P/B ratio < 1 simply provides an assurance to the shareholder that he/she can get back all (in theory) of his invested capital if the company was to go bankrupt.

Simplified Example: If I pay $1 for a share of a company with a P/B of 0.5, and if the company was to be liquidated today, I will in theory get back $2 as a shareholder. In practice this may be less than $2 due to expenses for liquidation and other factors. On the contrary, if I bought a share worth $1 of a company with a P/B of 2, I will at most get back $0.50 if the company was liquidated.

In summary, P/B looks at the value of a company at the point in time when the book value and P/B ratio were calculated.

The problems with using P/B is that it does not take into account the *future* earnings of the company and assumes the total value of its assets is correctly calculated. A company with a P/B ratio of 0.5 does NOT necessarily mean it’s a wonderful company with strong revenue growth.

There are many companies whose P/B ratios remain quite constant through the years. Eg. property development companies.

DCF: This refers to the sum of future Free Cash Flows (FCFs) that can be potentially generated by a company, discounted to present value. It is typically used by value investors to calculate a DCF-based fair value.

To understand this, you need to know the concept of “the time value of money”. In layman’s terms, “time value” refers to the fact that a dollar today may not be worth a dollar in the future due to inflation or deflation. So if a company can generate $2 mill of FCF in the future, I need to discount it to present value to assess what this future $2 m is worth today.

The simplified formula of a DCF-based fair value = Sum of Discounted FCFs divided by number of shares. The calculation can be much more complex due to what is the correct discount rate and the growth rate of FCF to use.

The advantage of using this is that I can judge a company’s worth or fair value by taking into account its future FCF growth (i.e. earnings growth). It definitely provides a more accurate view of a company’s future vs P/B ratio.

The downside of using DCF is that it is very sensitive to the inputs you use (discount rate, growth rate, etc.), hence “garbage in, garbage out”. The calculated fair value can vary a lot based on the input parameters. Also the psychological aspects -- sometimes we may tweak the inputs to our liking subconsciously, hence deriving an overly optimistic fair value.

As stock prices are typically driven by strong revenue growth (as per my observation), using DCF-based fair value will be more appropriate over P/B ratio if you want to maximise investment returns.

In conclusion, P/E and P/B ratios provide a very limited view of a company’s future growth. DCF valuation is often more appropriate. Having said all these, valuation metrics still pretty much serve as a rough estimation and guideline only. In reality, the market may be irrational (esp in the short-term) and many participants do not obey valuation metrics.

Hope this helps!

Tuesday 5 February 2019

(Post 78/week 60)TipforThought:how to mail and selling on carousell tip and tricks

This week tipforthought is about how to post a mail and some carousell tip, tricks, and hacks that I have research and used

Please do visit my carousell page if you would like to purchase any cheap second-hand book

My carousell:carousell.com/eric996

How to post a mail?

Actually posting a mail is quite easy, you need to purchase the envelope and the stamp and off you go!

Step 1.Purchase the envelope

1. Regularly update your carousell

By regularly updating your carousell with listing, this has enable my carousell to have more sales.

As this article from Sonia point out, this is due to 3 reasons

1. Your followers get your updates in their browse views

2. Your new listing will show up on the homepage for random browsers

3. Newer listings appear higher when one uses the ‘recent’ filter

2.Updates on weekend

The best time to post on carousell is on a weekend as most people would have time to browse through the listing during the weekend

3.Delete and re-update your listing that is old

For those items that you have listed more than 3 month and above, you should delete and re-upload the listing so that it would help to boost your sales more

4. Share your listing on gumtree and facebook group

Gumtree and facebook group selling second-hand book has a lot of potential buyers, some of my buyers come from gumtree.

5.Create a template to handle customers to save time

In my personal experience, I have created a template to reply to customers to save some typing energy(think of it like an answer or an automated chat bot).

If the buyer makes an offer, this is how I will reply...

1. Meetup is at an extra charge of 50 cents and mailing is at an extra charge of 1.50

2. Hi meetup is at xxx MRT only due to the low cost of the item

If the buyer chooses to meet up, this is how I will reply...

1. Hi, I will only be able to meet up on the weekend

and continue to discuss with him on the arranged timing, however, if the buyer opts for the mailing option

1.Ok sure, pls make payment via paylah at xxx

2.Would I have your address for mailing purpose?

If the buyer does not have pay lah, this is how I will reply...

1. My bank acc is xxx, please let me know when you transfer

2.Would i have your address for mailing purpose?

And last but not least, remember to thanks your buyers...

1.Please notify me when you have received the item and thank you for purchasing from me

That's all for this week tipforthought!

Please do visit my carousell page if you would like to purchase any cheap second-hand book

My carousell:carousell.com/eric996

How to post a mail?

Actually posting a mail is quite easy, you need to purchase the envelope and the stamp and off you go!

Step 1.Purchase the envelope

- You can choose to purchase an envelope from either popular bookstore(around $3.50 for 10 pcs of A4 envelope if my memory serves me right) or any stationary shop or even Daiso(Try not to purchase from singpost outlets itself as it is a tad expensive).

- In my case, I purchase A4 envelope from the Tesco supermarket in Malaysia when I make my monthly trip there due to it being cheaper than Singapore envelope price

- Below is an example of the envelope that I have purchased

Step 2: Purchase the stamp

- For purchasing of the stamps, you can easily do it at the nearest sam machine(see pic below)

- Here are the postage rates, for more information refer to the singpost website here

- As I am using A4 envelope which also means C4 envelope, I will be purchasing $0.60 stamp from the SAM machine

Step 3:Write the buyer address,your return address and paste the stamp

- Write the buyer address in the red box,e.g Pasir Ris drive 51 Blk 123 #02-01 s600123

- Paste the stamp in the orange box

- At the other side of the envelope,write the return address (your own home address) for return mail just in case, in the orange box,e.g Tampines drive 52 Blk 456 #03-02 s601456

Step 4:Mail it out

In the second part, I will be talking about some tip that I used to sell on carousell...

1. Regularly update your carousell

By regularly updating your carousell with listing, this has enable my carousell to have more sales.

As this article from Sonia point out, this is due to 3 reasons

1. Your followers get your updates in their browse views

2. Your new listing will show up on the homepage for random browsers

3. Newer listings appear higher when one uses the ‘recent’ filter

2.Updates on weekend

3.Delete and re-update your listing that is old

For those items that you have listed more than 3 month and above, you should delete and re-upload the listing so that it would help to boost your sales more

4. Share your listing on gumtree and facebook group

Gumtree and facebook group selling second-hand book has a lot of potential buyers, some of my buyers come from gumtree.

5.Create a template to handle customers to save time

In my personal experience, I have created a template to reply to customers to save some typing energy(think of it like an answer or an automated chat bot).

If the buyer makes an offer, this is how I will reply...

1. Meetup is at an extra charge of 50 cents and mailing is at an extra charge of 1.50

2. Hi meetup is at xxx MRT only due to the low cost of the item

If the buyer chooses to meet up, this is how I will reply...

1. Hi, I will only be able to meet up on the weekend

and continue to discuss with him on the arranged timing, however, if the buyer opts for the mailing option

1.Ok sure, pls make payment via paylah at xxx

2.Would I have your address for mailing purpose?

If the buyer does not have pay lah, this is how I will reply...

1. My bank acc is xxx, please let me know when you transfer

2.Would i have your address for mailing purpose?

And last but not least, remember to thanks your buyers...

1.Please notify me when you have received the item and thank you for purchasing from me

That's all for this week tipforthought!

Sunday 30 December 2018

(Post 72/week 54)TipforThought:10 financial tip,tricks and hacks

Saw some saving tip in an article in the magazine and would like to share here

Here are some tips that will help you manage your budget and add to savings...

1.Create your monthly budget

2. Get a piggy bank

3. Try shopping at thrift stores

4. Find the way to happiness and life, not to spend

5. Automate your bills

6. Stay away from the catalogs

7.Borrow books from the library

8. Buy a product that comes with a warranty.

9. Don't spend much on trendy clothes

10. Exercise daily from home

None of the above mention tasks are difficult, you can easily become adapted to them by making a small effort. I am sure that these methods collectively will help you save a significant amount of money

Here are some tips that will help you manage your budget and add to savings...

1.Create your monthly budget

- You are most likely going to spend more then necessary if you do have a pre-planned monthly budget. Keep a clear record of your earning and spending habits, and plan a budget accordingly.

- In my case, I do not have a pre-planned budget but I have a fixed amount of cash in my wallet that I put at the start of the week allowing me to keep track of my expenses easily.

- There is no doubt that credit and debit offer you an easy way to make payment.

- However, using cash will help prevent spending more as you will budget accordingly. You will also be protecting yourself from potential credit card theft and other fraudulent activities.

2. Get a piggy bank

- It may seem childish, but starting a piggy bank is a great habit that will enable you to add to your savings.

- You can either fix an amount to put in your piggy bank daily or simply empty your pockets into it at the end of each day.

- In my case, I empty my coins out into the piggy during the weekend.

- You can also opt for an auto transfer from your main bank account to your sub-account(money cannot be seen are money that cannot spend)

3. Try shopping at thrift stores

- Thrift stores are a great place to buy an inexpensive yet decent secondhand household item that people have donated.

- Talking about second-hand item, do visit my carousell page for second hand books:carousell.com/eric996

4. Find the way to happiness and life, not to spend

- Rather than finding happiness in shopping which is temporary and a never-ending cycle,you should do healthy things that you love to do.

- This will allow you to enjoy your life better along with adding to your saving accounts.

- For me, I love doing side business such as blogging, investment,carousell whatnot's etc

5. Automate your bills

- Bill should be automated so that you do not forget to pay your bill and incurred late payment, besides it is easy to keep track of through your bank transaction

6. Stay away from the catalogs

- If you have subscribed to catalogs and emails for different brands to hear about their latest launched then unsubscribe, the engaging advertisement will tempt you to buy the item you have no true need for.

7.Borrow books from the library

- Hard copies of books are too expensive and many of these books are such that you would not read them once exams and classes are over.

- So instead of spending money on these books, you can borrow them from the library. You can also try EBook.

- It is quite common for a publisher to sell both the eBook and hardcover copy now. What's more, they can be downloaded for free online(Google is your best friend).

- If you are an avid reader, you should try reading eBooks as it is a convenient and economical way to learn. Also, EBook is very convenient as you can download many books and store them on your tablet.

8. Buy a product that comes with a warranty.

- There are plenty of products for which some companies offer a warranty.

- It will not only give you confidence in the quality but will also save you money on potential repair if they happen within the warranty period of time

9. Don't spend much on trendy clothes

- Trendy clothes may help you gain popularity but most of the time, they are a waste of money because you may not wear them since the trend fades out.

- So try to buy clothes that are timelessly trendy.

10. Exercise daily from home

- Exercise should be a not-to skip part of your daily routine as it keeps people healthy and saves on money that otherwise you would spend on medication and hospital bills.

- This does not mean you should join a gym. You can easily practice exercising at home and avoid paying a monthly bill to the gym

None of the above mention tasks are difficult, you can easily become adapted to them by making a small effort. I am sure that these methods collectively will help you save a significant amount of money

Sunday 16 December 2018

(Post 67/week 51)TipforThought:ShinyThings thread tip 1

In April as I was learning the ropes on stock investing(i am still learning btw), I came across the shiny thing thread on the hardware zone forum. There are certainly many interesting tips which are spread out over the long-running thread, I saved quite a few of them as I found them to be very insightful. Here are some of them

1)

Question 1: May I have some suggestion on how to start my investments? e.g invest in ETFs, bonds? and which platform should I do the investment? e.g through SGX directly, or through banks like POSB invest saver, DBS Vickers, OCBC blue-chip investment?

Answer 1: Start by investing into a mix of ETFs: local stocks(ES3, the STI ETF); local bonds(A35, the ABF Singapore Bond ETF); and global stocks (IWDA, which tracks the MSCI World index).You can do this through POSB Invest-Saver(for the Singapore ETFs) and stanchart(for the global ETF). Every other broker is worse, either they are more expensive, or they rip you off with unnecessary fees or both

One thing that's worth mentioning though, you'll always need to go through a bank or broker. The SGX is just an exchange, so it's where people come to trade, the bank or broker I where you place your trades, and then they go off to the exchange and fill those orders for you.

Key takeaways 1: Use POSB Invest saver for the Singapore ETFs, and standard chartered for the global ETF, due to other brokers fees(I am using DBS Vickers though).In my defence, it is because my broker gives me a lot of useful reports and tips, hahaha, but I am starting to transit into using standard chartered due to the cheaper fee incurred when trading

2)

Tip 2:The principle of buy and hold and rebalance still applies no matter where you live.

If you live in Singapore, you buy a mix of the STI ETF and the ABF bond fund, and rebalance once a year.

Don't fall into the trap that since US stock have so well the last few years, you want to hop on that train, sell all my STI and get me into the S&P!. That's is the exact opposite of what you want to do. Completely aside from all the currency risk,you're taking on, you want to SELL the things that have outperformed, not buy them.

Key takeaway 2:Relance once a year but selling the stock that are outperforming.Don't follow the trend too much and eager to hop onto the train quickly(yes, bitcoin I am looking at you)

3)

Question 3: Which countries market would I be looking for?And which broker would be good for this?

Answer 3: The ETF can be listed anywhere, but generally what you are going to want is a nice, boring, simple global equity ETF. Around here, VWRD(listed on the London stock exchange) is the preferred pick

It's worth looking at the UK's ETF listings because those typically have better tax treatment than US ETF(less of your dividends get withheld)

Key takeaway: Choose VWRD as the global equity ETF as it has a better tax treatment than US ETF

Question 4:Are vanguard ETFs the only one worth looking at? And which of them would be suitable?

Answer 4:Stick to vanguard and I Shares. Ignore everything else,

Key takeaway 4:Vanguard or I Shares only for global ETF.

Wednesday 28 November 2018

(Post 61/week 48)TipforThought:Bill gates helpful lessons

I just chance upon this interesting article and decided to take a picture. Some wise words from bill gates.

It read as follow...

Bill Gates gave a speech at high school about 11 things they will not learn in school. They are...

1. Life is not fair, get used to it

2. The world won't care about your self-esteem. The world will expect you to accomplish something before you feel good about yourself

3. You will not make $60,000 a year out of high school. You won't be a vice president with carphone until you earn both.

4. If you think your teacher is tough, wait till you get a boss

5. Flipping burgers is not beneath your dignity. Your grandparents had a different word for flipping, they call it opportunity.

6. If you mess up, it is not your parent fault, so don't whine about it and learn your mistakes

7. Before you were born, your parent aren't as boring as they are now. They got that way from paying your bills, cleaning your clothes and listening to you talk about how cool you thought you were. So before you save the rain forest from the parasites of your parent's generation, try declosing the closet in your room

8. Your school may have done away with winners and losers but life has not. In some schools, they have abolished failing grade and they give you as many times as you want to get the right answer. This doesn't bear the slightest resemblance to anything to real life.

9. Life is not divided into semesters. You don't get summers off and very few employers are interested in helping you find yourself. Do that on your own time.

10. Television is not real life, in real life, people actually leave the coffee shop and go to work

11. Be nice to nerds, chances are you will end up working for one

Thursday 12 July 2018

(Post 38/week 29)Tip for thought:khan academy investment lesson 1 short summary

1)How long does it take to double your money?

- Use the rule of 72 to calculate

- For example, if the percentage is 10% annually, you will take 72/10=7.2 yr to double your money

P=principles amount

I=interest

T=time

- After 1 year, which means t is 1

- Amount to pay after 1 years=p+p

- So assuming the principal amt is 50dollar and the interest is 15%

- After 20 years

- 100%=50

- 15%=7.5

- 20*15=150

- The total is 150+50=200

3)Calculating compound interest

P=principle amount

I=interest

T=time

N=number of time that will be compound in that year

Formula for calculating compound interest:P((1+(r%/n))^(n*t) simplified to p(E^r%t)

- E.g principle of an amount is $50

- Time: Have to pay for 3 years

- N=number of time that will be compound is 4

- I=interest is 10% compound annually

- 50((1+(0.10/4))^(3*4)

- =67.49

- A debtor=the person that borrow the money

- A creditor=the person that is owed

- Asset=an asset is something that will give you economic benefits in the future

- Cash is An asset because it allows you to buy things in the future

- Liability: a liability is an economic obligation to someone

- Asset=liability+equity

- Equity: just what you own

- Let say I want to buy a house that is $250000, I have no debt to be pay hence my liability is $0 and my equity is $250000

- Collateral= something you own to a bank in exchange to get money from them

- Marking to market=this mean that every few months or so, I will look at the asset and review it's net worth price currently(because asset like stock will fluctuate)

- Leverage=leverage is when you use debt to buy an asset

- Security=is essentially something that can be bought and sold and has economic value

- Security in the equity world is stock

- Security in the debt world is bond

- E.g if they are giving a 6 % coupon bond this just means that they are going to give me 3% of my bond twice in the year

- 2% inflation=1.02

- Amt=$110

- 110/1.02=$107.8

8)Scenario example for understanding

- I own a cupcake factory

- It is able to produce a million cupcake per year, and I sold 1 million cupcakes at $2 each

- Hence, my revenue will be 2 million per year

- Cogs=cost of goods(or rather cost to produce cupcake)

- 1million cupcake=$1 million

- 2million-1million=1million, this is known as gross profit

- Overhead expenses=advertisements, exporting of the cupcake, e.g overhead expenses is 500thousand

- Operating profit=gross profit-overhead expenses=500thousands

How much a share is worth?

To know how much a share is worth, take the equity of the company divided by the no of share

E.g the equity of the company is 20million and the no of share is 2million, We take 20million/2million=10dollars, So if the share price is below 10 dollars we buy and if its above 10 dollars, we do not buy.

- Price of share=stockholder equity/no of share

- Last action-how much was this share bought or sold for

- Bid-how much someone is willing to pay for the share

- Ask-how much someone is willing to sell the share

- 52wk range-the range of the share price in 52 Wks

- Average vol-this is the number of shares sold per day

- Market cap-how much the market think that this company is worth

- To calculate the market cap, take the last action price x the no of share

E.g a company has 4 shares, each of the share is worth $2, hence company total assets is now $8 to raise money the company can divide the share more e.g to 6 share,the share price are still the same at $2 just that the percentage of the company you own has changed(which is not important) and the company now has an asset of $12

11)The merger of the company = the share price will rise

12)Basic leverage buyout example

Let say your business is worth 1 million and earn 1.5million each year and you have to pay 1/3 of taxes each year and then I say I would buy your company for 10 million, to you it is a very good deal as it is ten time of what your company is worth

But however, I only have one million so how do I raise the remaining 9 million to buy your company?

I go to the bank and say, hey I would like to borrow 9 million from you and I am going to put the business as a collateral and you can charge me at 10% per year

So before that, I have a pre-tax income of 1.5million after minus the 900k(which is the interest of 9 million), this means I have a pre-tax income of 600k

The cool thing is that corporate interest is tax deductible so paying 1/3 of 600k is 200k which leave me with 400k, pretty good eh?

13)A private company is one who shares are not traded on a public exchange

List Of Other Blog Post

Sunday 29 April 2018

(post 19/week 18)tipforthought:Singapore saving bond(SSB) is good but i do not have any!

5.An interesting article to read this week

Link:https://blog.seedly.sg/investment-products-below-1000/

Summary:

There are various product in the market that requires less than $1000 to invest

1.Singapore saving bond(SSB) which require a minimum amount of $500

2.Robo-adviser(smartly,autowealth,stash-away)

3.Sti ETF and abf Singapore bond via regular saving plan(posb)

4.Money market fund(FundsuperMart)

Just to add on one more product...

5.Peer to peer lending(moolahsense, funding societies)

Why invest in Singapore saving bond(SSB)?

To me, Singapore saving bond(SSB)belong to the lowest level of investment, level 1(low-risk low return) but I think it is more reliable than either money market fund or those insurance saving plans that are introduced to you by an insurance agent

Being young and being greedy(Laughs), I do not have any Singapore saving bond but just for information sake, here is how you can buy Singapore saving bond

Research link:http://www.sgs.gov.sg/savingsbonds/Your-SSB/How-to-buy.aspx

Next week, I think it's finally time to talk about my posb invest saver plan back from 2016(probably going to be a long one), do look out for my post!

Link:https://blog.seedly.sg/investment-products-below-1000/

Summary:

There are various product in the market that requires less than $1000 to invest

1.Singapore saving bond(SSB) which require a minimum amount of $500

2.Robo-adviser(smartly,autowealth,stash-away)

3.Sti ETF and abf Singapore bond via regular saving plan(posb)

4.Money market fund(FundsuperMart)

Just to add on one more product...

5.Peer to peer lending(moolahsense, funding societies)

Why invest in Singapore saving bond(SSB)?

- Singapore saving bond(SSB) has an advantage over other instruments such as your saving account and fixed deposit

- ·It's government-backed(AAA credit rating)

- ·It's just require a minimum amount of $500 to invest and its return is above 1-2% per annum

To me, Singapore saving bond(SSB)belong to the lowest level of investment, level 1(low-risk low return) but I think it is more reliable than either money market fund or those insurance saving plans that are introduced to you by an insurance agent

Being young and being greedy(Laughs), I do not have any Singapore saving bond but just for information sake, here is how you can buy Singapore saving bond

Research link:http://www.sgs.gov.sg/savingsbonds/Your-SSB/How-to-buy.aspx

- Step 1: Open an account with any of our Singapore local bank(DBS/POSB, OCBC, UOB)

- Step 2.Open a CDP securities account with any of our Singapore local bank brokers preferably with our local bank brokers for easy access and convenience, just head down to the bank to apply(DBS VICKERS, OCBC SECURITIES, UOB KAY HIAN)

- As for me, I open an account with DBS VICKERS by visiting our Singapore invest fair at 2016 when I turn 20 that year

- Step 3: Buy Singapore saving bond(SSB) via online banking or through ATM(there is a transaction fee of $2)

- Step 4: Sit back and collect your interest every 6 months (it will be pay to your bank account that is linked to your CDP account)

- Step 5: Lastly, get out there and start applying the Singapore saving bond today!

Next week, I think it's finally time to talk about my posb invest saver plan back from 2016(probably going to be a long one), do look out for my post!

List Of Other Blog Post

Sunday 22 April 2018

(Post 17/week 17)Tip for thought:Job portal in sg and Common interview question

1.An interesting article to read this week

Note: I am not affiliated to any of the organization mentions below(except saf, hahaha)

Came across this interesting article on Quora about the various job portal in Singapore and thought that I would like to share with you all

Link:https://www.quora.com/What-are-the-best-job-portals-in-Singapore

Summary:

A list of job portal for full and part-time job

1) JobsDB

2) Jobstreet

3) Jobs Central

4) Jobs Bank

5) Linkedin

6) Monster

7) Gumtree

A list of job portal for job internship and startups

1) Glint

2) InternSG

3) Stroff

4) Startup jobs

Portal for working professionals advice and job seekers/professional to seek advice on personal career development for workplace success.

1) Robert Walter career advice

2) Styleguide

2.Tipforthought: Common interview questions tips(taken from an article mostly, haha)

Question 1: Tell me more about yourself

Question 4: Where do you see yourself in 5 years time?

You must be familiar with the company culture and job description as you have to showcase your compatibility with the job and company. Also, talk about your skill set, experience and past achievement and knowledge to set you apart from the rest of the candidate

Extra tip

Note: I am not affiliated to any of the organization mentions below(except saf, hahaha)

Came across this interesting article on Quora about the various job portal in Singapore and thought that I would like to share with you all

Link:https://www.quora.com/What-are-the-best-job-portals-in-Singapore

Summary:

A list of job portal for full and part-time job

1) JobsDB

2) Jobstreet

3) Jobs Central

4) Jobs Bank

5) Linkedin

6) Monster

7) Gumtree

A list of job portal for job internship and startups

1) Glint

2) InternSG

3) Stroff

4) Startup jobs

Portal for working professionals advice and job seekers/professional to seek advice on personal career development for workplace success.

1) Robert Walter career advice

2) Styleguide

2.Tipforthought: Common interview questions tips(taken from an article mostly, haha)

Question 1: Tell me more about yourself

- A common starting interview questions to break the ice for interviewers to know more about you.

- Do prepare a short presentation about yourself, give a brief summary of your personal details(hobbies, community involvement, education qualification and work experience)

- Do not boast too much of yourself and do not put yourself down(always late for appointment etc)

- Do Share 1 or 2 weakness and mention how you overcome them and do mention about 3 strength which would make a positive impression about your capabilities

- This is a question where you have to think through carefully by doing research on the company culture and industry

- Never give answer such as "I was attracted to the workplace benefit" or "the workplace is near my home"

- Most importantly is that you must let the interviewer know that you are selective of your job and not just take any job that is available to.you

Question 4: Where do you see yourself in 5 years time?

- This question is often probed by the interviewer to see that if you are someone that set goals as employers believe that people who set goals are more reliable than those who do not set goals

- Do give answer such as "I would like to be head of marketing in the next 5 years" or "I would like to take up more challenges and learning opportunities in my career where necessary"

- Do not give an answer such as "I wish to have a family in 5 years" or "earn my first millions in 5 years"

You must be familiar with the company culture and job description as you have to showcase your compatibility with the job and company. Also, talk about your skill set, experience and past achievement and knowledge to set you apart from the rest of the candidate

Extra tip

- 1. Ask the interviewer some question to show interest in that such as"can I have more in-depth details on the job scope?" Or "what will be the work environment like?"

- 2. Write a thank you mail to the interviewer after the interview to thank the interviewer for the chance of opportunity and to learn more about the job

- 3. Lastly, if you are caught up with something, do reschedule with the interviewer\

List Of Other Blog Post

Subscribe to:

Posts (Atom)