- Your parents are the only people who become genuinely happy when you succeed.

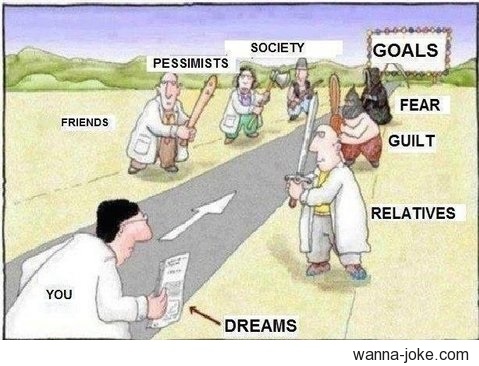

- People want to see you succeed… but not more than them.

- A friend in need is a friend indeed. The reverse is true if you get what I mean.

- The way you are brought up contributes about 70% to the person you grow up to be. unfortunately, we don't get to choose our parents.

- Genuine love is rare if you stumble upon it cherish it.

- Nobody will die for you. You are on your own so man up.

- Life is so unfair but it is still beautiful.

- Bad things happen to good people.

- Growing up comes with more responsibilities, thus life gets even harder as you grow.

- Life is a journey with an unknown destination. You only cross the bridge when you get there… sometimes you are not even sure whether the bridge is there or not. Live today tomorrow is not promised.

#1. Aiming too low. Whether it’s salary, title, or type of company, people are too intimidated by interviewers, scared of asking for what they want at every stage of the interview process, and suffer from imposter syndrome.

This is a direct result of decades of indoctrination by authoritative educational, parental, and societal institutions that tend to demolish your self-confidence in an effort to control you. This persistent lack of confidence is the #1 issue candidates suffer from when it comes to selling yourself effectively.

#2. Saying no to yourself. Because you feel that you lack the “qualifications” the job description asks for, you end up not going for the opportunity. This continued lack of self-confidence through self-discrimination, combined with the obsession of fulfilling requirements down to the last drop, handicaps good professionals from achieving career greatness.

Although job description doesn't matter, many candidates still try to play by the rules. They don’t understand that the job search is like war. The victor obtains the spoils. It’s every man and woman for themselves.

There are NO rules in job search! This is why often psychopaths and liars sometimes get the BEST jobs and offers. They understand manipulation.

Too often, the most accomplished candidates lose because they don’t know the song and dance that is the job search.

#3. Not understanding the modern job search ecosystem and process. There are 4 major hiring entities that you need to know how to manipulate, maneuver around, and negotiate with. The HR person, hiring manager, headhunter, and internal recruiter. Each person has a slightly different incentive, process, and interaction protocol. You should behave accordingly.

In addition, the process of job search is no longer: look on the web for listings, apply to jobs that you like, wait for feedback, go interview. The new process is: create your marketing documents (including your resume ), master LinkedIn networking, leverage the 4 hiring entities mentioned above, utilize the volume of interviews to your advantage, negotiate all throughout.

#4. Becoming a jack of all trades. The most dangerous problem candidates run into that seriously limits their market value and range of future career options is becoming a generalist. Corporations no longer value soldiers, willing to do any deed for pay. They want professionals, experts, and true masters of the industry and job vertical. They NEED these experts to remain viable and stay ahead of their competition.

No longer is being eager and willing to work for a firm for the next 25 years a valuable candidate trait. Firms want true market leaders. That means, specialization and experience within a niche skill are not only a good-to-have, but a MUST-HAVE to remain a relevant and desirable professional.

Lastly, #5. Having no financial plan nor power. Most professionals forget that they work largely to make a living. Since most people accumulate worse spending habits every year, people rely on their jobs more and more to fuel their lifestyle. This dependent relationship on a job quickly spirals out of control once their house of cards experiences even the smallest tremor.

Because of your deep reliance on your paycheck, your emotions run amok when experiencing any type of career turbulence.

Since your financial woes are so heavy and over-leveraged, you can’t see straight, let alone find a career you enjoy!

In most of these cases, professionals tend to work simply to chase the dollar, losing all meaning and passion for what they’re working towards outside of living the high life they buy with their post-tax dollars. They become money-mongers. Greed takes precedence. Career meaning, purpose, and ethical behavior quickly fall by the wayside when confronted by financial greed.

This is the #1 cause of corporate fraud, corruption, pollution, and general nastiness (think: Wolf of Wall Street, Enron, and Bernie Madoff). Individual greed driven by a need to keep up with the Joneses pollutes corporate cultures by attracting people who are in it just for the money.

In conclusion

Career problems aren’t simply an amalgamation of your job’s stressors. Your personal, financial, and professional problems, weaknesses, and vices will all meld together to gang up on you, if you let your guard down or stray off the righteous path of moral behavior.

Stay ahead of the game by learning, networking, and speaking with career experts, colleagues, mentors, and influencers that have the RIGHT advice to guide you.

Thanks for reading!

Thanks for reading!