(Post 32/week 24)Investment project updates:My first funding societies campaign experience/breakdown part 2

7. My first funding societies campaign part 2(continuation from last two-week post)

Read Part 1 here:https://sonicericsg.blogspot.com/2018/05/post-29week-22investment-project.html

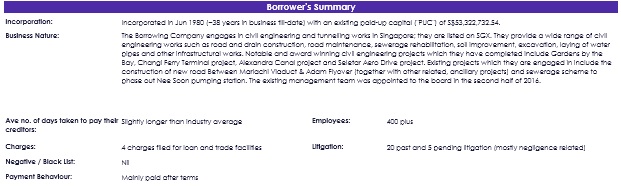

Borrower summary

Incorporation: Incorporated in Jun 1980 (~38 years in business till-date) with an existing paid-up capital ("PUC") of S$53,322,732.54.

Business Nature:

The Borrowing Company is engaged in civil engineering and tunneling works in Singapore, and are listed on SGX. They provide a wide range of civil

engineering works such as road and drain construction, road maintenance, sewerage rehabilitation, soil improvement, excavation, laying of water

pipes, and other infrastructural works. Notable and award-winning civil engineering projects which they have completed include Gardens by the Bay,

Changi Ferry Terminal project, Alexandra Canal project and Seletar Aero Drive project. Existing projects which they are engaged in include the construction of a new road between Mariachi Viaduct & Adam Flyover (together with other related, ancillary projects) and sewerage scheme to phase out Nee Soon pumping station. The existing management team was appointed to the board in the second half of 2016.

Ave no. of days taken to pay their creditors: Slightly longer than the industry average

Link 2:http://sdh.edu.sg/wp-content/uploads/2016/11/Embracing-Structured-Internship-1.pdf

Link 3:https://sbr.com.sg/professional-serviceslegal/commentary/charges-how-register-loan-secured-business-1

Litigation: 20 past and 5 pending litigation (mostly negligence related)

Litigation

Link:www.businessdictionary.com/definition/litigation.html

Payment Behaviour: Mainly paid after terms

Read Part 1 here:https://sonicericsg.blogspot.com/2018/05/post-29week-22investment-project.html

Borrower summary

Incorporation: Incorporated in Jun 1980 (~38 years in business till-date) with an existing paid-up capital ("PUC") of S$53,322,732.54.

Business Nature:

The Borrowing Company is engaged in civil engineering and tunneling works in Singapore, and are listed on SGX. They provide a wide range of civil

engineering works such as road and drain construction, road maintenance, sewerage rehabilitation, soil improvement, excavation, laying of water

pipes, and other infrastructural works. Notable and award-winning civil engineering projects which they have completed include Gardens by the Bay,

Changi Ferry Terminal project, Alexandra Canal project and Seletar Aero Drive project. Existing projects which they are engaged in include the construction of a new road between Mariachi Viaduct & Adam Flyover (together with other related, ancillary projects) and sewerage scheme to phase out Nee Soon pumping station. The existing management team was appointed to the board in the second half of 2016.

- As the borrowing company is engaged in many of the civil engineerings works such as road and drain construction and many another award-winning civil engineering project, this could be a sign that it has built on a good credible company and would probably be engaged to do another civil engineering project in Singapore in the future.

- You can see that I actually love to invest in SME that are listed on the SGX, as being listed as a public is a step up from being a private companies and would thus provide more awareness of the company,you can read about listing on catalist at this link(i am assuming that this company is listed on the catalist board of the sgx:http://www.legalbusinessonline.com/news/sponsored-listing-singapore-stock-exchange-mainboard-vs-catalist-part-2/72106)

- A catalist listing does not have a quantitative requirement but need to appoint a sponsor, who will access its suitability to list and will advise and guide the company through the listing process, The company must maintain the sponsor at all times after listing

- A catalist listing is supervised and approved by its appointed sponsor, once the prospectus(details of a share offer for the benefit of investors) for lodgement(the action of depositing or lodging something), the catalist listing application will lodge its prospectus with the sgx

- The catalist listing has a less stringent listing requirement as companies need not meet any minimum earning, operational track record or market capitalization requirements. It appears to be a viable option for small but fast-growing companies to list and issues shares to the public for fundraising purpose

- So from a normal person point of view, if the business is not good, would you be the sponsor for that business? I think not, hence I think this is another factor to consider

- In my opinion, It is ok to be longer than the industry average after all late payment is better than never!

Link 2:http://sdh.edu.sg/wp-content/uploads/2016/11/Embracing-Structured-Internship-1.pdf

- Ok, From the link above it seem that the definition of SME companies in Singapore have a group employment size of not more than 200 workers so the company may be actually instead an even bigger company than I thought and could maybe be even listed on the mainboard(which has even more stringent criteria),but lets assume the worse case scenario of it listed on the catalist board instead

Link 3:https://sbr.com.sg/professional-serviceslegal/commentary/charges-how-register-loan-secured-business-1

- Damn all this financial jargon, haha!, initially when I read through the report months ago, I thought this means that the company was being charged, guess its probably because of being a SAF soldier for too long(probably only Ns man that served in the army will understand the joke of "charge")

- Anyway, charge in this context(refer to link 3) basically mean the extent of rights a lender will have on the company assets. It is just security given (in writing) to the lender for the loan amount secured, you can think as an iou(informal document acknowledging debt)

Litigation: 20 past and 5 pending litigation (mostly negligence related)

Litigation

Link:www.businessdictionary.com/definition/litigation.html

- Okay,this definitely mean charged or lawsuit in court, litigation as inferred from the above link is the Ultimate legal method for settling controversies or dispute between people, organizations and the states, 20 past and 5 pending litigation (mostly negligence related),it is probably due to safety concern which results in workers accident which is common in industry like construction and civil engineering,this definitely get a -1 from me

Payment Behaviour: Mainly paid after terms

- Better late than never

List Of Other Blog Post

Comments

Post a Comment